Tagged: assurance

Art¢oin:\>_Block No. 2

2021 Mintage

🪙#47

Owner: N. Liu And K. Wilson | .999 Ag | A-Series | Wedding gift

2022 Mintage

🪙#48

Owner: N. Jones & B. Session | .999 Cu | B-Series | $230 (October 2023)

🪙#49

Holder: The Colonial Lodge No. 1821 c/o WM Kevin Coy | .999 Cu | B-Series | Deposit

🪙#50

Owner: C.P.A. LLC c/o NOVUS SYLLABUS | C-Series | .999 Cu | Private Reserve

2023 Mintage

🪙#51, 52, 54, 55

Owner: C.P.A. LLC c/o NOVUS SYLLABUS | C-Series | .999 Cu | Private Reserve

🪙#53

Owner: A. Driver | C-Series | .999 Cu | Exchange

🪙#56-58

Owner(s): B. Woudie & A. Ebrahimi; J. Michelle; J. Penn | D-Series | .999 Cu | Token of Gratitude

🪙#59

Owner(s): W. & M. Baynard | D-Series | .999 Cu | Token of Gratitude

2023 Sales

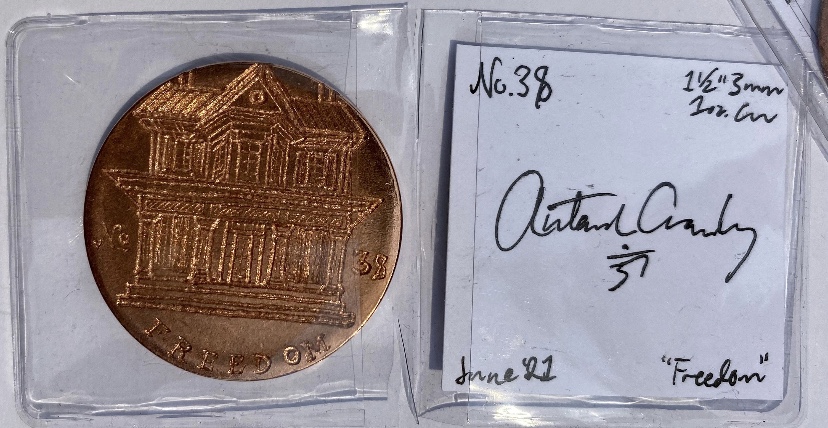

🪙#38

Owner: J. Vincent | A-Series | .999 Cu | $180 (July 4, 2023)

An Assurance Policyholder (“Private”) shall be vested with one (1) “C” Series Artcoin (“C coin”) upon conference of Assurance Policy by and payment of premium service fee to the C.P.A. LLC Office of Ombudsman via handshake.

LH ADM Antarah, L.S.T.A., D.A.O.

📜CALL TO SEA (“C”)⚓️

CALLING ALL PRIVATES (“SEAMEN”), ADMIRALS, GENERALS AND SOVEREIGNS IN EQUITY, ECCLESIASTIC AND COMMON LAW TO ASSEMBLE ON THE EASTERN SEA BOARD OF THE ADMIRALTY OF THE DECENTRALIZED AUTONOMOUS ORGANIZATION OF THE L.S.T.A. ON THE SIXTH DAY OF JANUARY IN THE YEAR OF OUR LORD TWO THOUSAND TWENTY-THREE AT THE PORT OF [——] 8TH ST N.E. IN THE D. OF C.

OUR MISSION IS TO PROMOTE THE STRAIGHT AND NARROW WAY OF INTEGRITY, THE PATH OF POETRY AND PHILOSOPHY (LES HOMMES DU BELLES LETTRES), AND THE OPEN SEA OF ROMANCE AND ADVENTURE (ROMAN VENTURE/PRIVATE EQUITY). ALL ACTS ARE ADMINISTERED TO PRIVATES KNOWINGLY INTELLIGENTLY AND VOLUNTARILY; WE DO NOT MAKE PROMISES, BIND PEOPLE OR ADMINISTER OATHS AS OUR LORD SAYS IN MATT. 5:33-37.

WHILE WE ARE A BROTHERHOOD OF CHRIST, THE SEA BOARD AND PRIVATE CORPS (OF “MEMBER SHARE HOLDERS”) CONSTITUTE A PARAMILITARY PSEUDO-MAGICAL COUNTERINTELLIGENCE AGENCY ADMINISTERING UNIVERSAL LAW VIA THE ANCIENT DIALECTIC METHOD OF REPLICATE IN REVERSE.

OUR GENERAL POLICY STATES THAT ONE WHO LIVES [“CQV”] HAS SURETYSHIP THROUGH FAITH IN CHRIST AS SECURED PARTY CREDITOR OVER THE COMMON LAW PUBLIC LEGAL ENTITY [DEBTOR COMPANY] NAMED ON THE BILL OF LADING SENT TO THE GOVERNMENT [“BIRTH CERTIFICATE”] PROVING BY ACTUAL SIGNATURE [AS CQV CANNOT KNOWINGLY INTELLIGENTLY AND VOLUNTARILY “EXECUTE” B.C. ON THEIR OWN BEHALF AS MINOR INFANT] THAT THE SURETY OF THE COMPANY IS NOT DEAD OR LOST AT SEA BUT A WO/MAN ON THE LAND OF GOOD STANDING, SOUND MIND, LEGAL MAJORITY AND FINANCIAL MATURITY; AND THAT THE PRESUMED PUBLIC [MILITARY] TRUSTEE OF THE COMPANY ESTATE [CORPUS] HAS NOT ACTED IN GOOD FAITH; WHEREFORE ANY SUCH CONTRACTS EXECUTED UNDER THEIR AUSPICES ARE VOID AB INITIO.

THE POLICY UNDERWRITERS ARE GOD AND THE AUTHORS OF THE KING JAMES BIBLE. C.P.A. LLC IS ONLY AN AGENT OF SUCH ASSURANCE BY VIRTUE OF ISSUANCE OF C-COIN UPON CONFERENCE OF POLICY IN CONSIDERATION OF SERVICES RENDERED TO POLICYHOLDER.

Assurance Policy

A POLICY IN RE:

PERFECTING YOUR SECURITY INTEREST IN TRUST ‘INRI’

Let us draw near with a true heart in full assurance of faith, having our hearts sprinkled from an evil conscience, and our bodies washed with pure water.

Hebrews 10:22

Verily, this Policy of Assurance is within you and your private ‘sui’ jurisdiction, which is moored in the vessel, whose NAME is Your soul’s Title, which saileth upon the Holy Sea.

Your Friendly Neighborhood Ombudsman

IESVS NAZARENVS REX IUDÆORVM

I. Merriam-Webster defines “Assurance” as the state of being secured or certain; to be sure; or, the action of securing something or someone by a pledge or guarantee. Assurance means to provide surety or confidence to oneself or another.

II. This is a policy by which a living man or woman may indemnify themself against commercial death (of debt executed in their name) through the Redemption and Prepayment of “Yahshuah” the Christ, Savior, Redeemer, Counsellor-at-Law and King of Your Sui Jurisdiction.

III. Through Firm Belief in the Redemption of the Body (of the Dead/Debt) by Acceptance of the Charge in The Name of Our Lord and Savior, we can establish complete Trust in our own Sui Jurisdiction; and in good Faith discharge our deaths/debts under Public Policy. In other words it is said: Faith is complete Trust and firm Belief, or acceptance of a matter as true (the pledge or oath of signature). Such Belief, sincerely held, cannot be converted into a crime.

IV. The internal body and soul of the living man and woman is a sovereign occupying the position analogous to that of other sovereigns in the family of nations. Therefore it is private with respect to the public, and foreign, international and alien with respect to to the national governing corporation.

V. The external name and shadow of the living man and woman are subject to external factors. The physical body and central nervous system (CNS) is the vessel through which the internal communicates with the external. However, the internal living soul maintains jurisdiction over external property to which it holds Title (this is because a body can exist without a soul). Such Titles include the vessel NAME, the vessel shadow’s registered security Account Number, the registered certificate of live berth of vessel, and all vessel licenses and registrations emerging therefrom. The shadow itself is the external object used by the cunning executor to bind the living soul in a “dead corpus of a vessel”, as it is said, “the deceased is depicted emerging from the tomb by day in shadow form, a thin, black, featureless silhouette of a person. The person in this form is, as we would put it, a mere shadow of his former existence, yet nonetheless still existing,” (Goelet, Ogden, Jr. (1994)).

VI. The dichotomy between the living child of god and the “debtor’s corporate vessel” in commerce creates the “double” spirit and entity or person. The one is a sovereign sui juris personam; the other is subject matter in rem. That which the private/internal conducts between the public/external is international and alien (a lien).

VII. Things necessary to perfect a lien are these: (1) The Lienor shall serve notice on the owner/principal or their agent on paper under solemn oath, (2) by United States Marshal, (3) which shall contain clear information so as to frame responsive pleadings, (4) be served to the US District Court where the res is located, and (5) posted by US Marshal on the res of the seizure.

VIII. Admiralty means that a valid international contract is in dispute. All revenue causes proceed against property and rights to property in rem and in Admiralty because such causes concern a re-venue-ing of matter from the internal private to the external public; hence the Interna(tiona)l Re-venue Service. This diversity of venue creates the overlapping public and private (or sui) jurisdictions that allow the foreign entity known as the federal government to engulf all shadows within its penumbra.

VIII(a). A Lord (seigneur, i.e. “signer”) may grant a fief (or benefice, “benefit”) of valuable consideration (e.g., property, rights, or possessory interest therein) to another to hold in fee (“in fealty,” or “in good faith”) in exchange for a pledge of allegiance or service. Feoffment is a deed which grants or conveys ownership of freehold property to someone in exchange for a pledge of service. Otherwise it is said, Feoffment is the total relinquishment and transfer of all rights of ownership of an estate in land from one individual, the feoffor, to another, the feoffee, in exchange for some valuable consideration. In such cases, the person entitled to grant an estate may do so for the use of another (a Lessor). Use and trust are rooted in medieval law and are a legal way to avoid feudal services due to one Lord by granting land for the use of another (Cestui que use) who owes nothing to the Lord (i.e. no services). This arrangement separated legal ownership from beneficial ownership. Furthermore, one who owns property for the use of another is obliged to fulfill their trust.

IX. Whereas diverse Lords of Mannours and others have granted Estates by Lease for the term of one life or more, And it hath often happened that such person for whose life such Estates have been granted have gone beyond the Seas or so absented themselves from this Realm for so many years that the Lessor(s) or person(s) entitled to have the property back (Reversioners) cannot find out whether cestui a que use le feoffment fuit fait be alive or dead. Otherwise it is said, Cestui que vies have gone beyond Seas, and Reversioners cannot find out whether they are alive or dead!

X. For remedy of which mischief “so frequently happening to Such Lessors and Reversioners, being held out of possession of their Tenements for many years”, if Cestui que vie remains beyond Sea for Seven Years together and provides no Proof of their Lives, then in every Action brought for the recovery of the said “Tenements” by the Lessors or Reversioners, the Judges before whom such Action shall be brought shall direct the Jury to give their Verdict as if the person so remaining beyond the Seas or otherwise absenting themself were naturally dead. Ego these public trustees abuse the law to execute the Lord of Manors in order to secure the estate of the child in trust to the benefit of the trustee for the term of the life of the person for whom such estates had been granted (cestui a que usage le feoffment fuit fait). That is how the government Lessors squat the estate of a sovereign Lord of woman born.

XI. As Cestui qui vie, I am the Lord; I am the accommodation party for my vessel shadow (“strawman”) and I am the sponsor for the credit on every instrument I endorse for my strawman. I am the source of the energy. I am the sponsor for the credit when the offeror passes over the promise to deliver the check or obligation and draws on me as though I am a bond in which the offeror overdrafts and I in turn loan him the value of the instrument of his offer to which he is now in bondage in accordance with Public Policy. I am the principal from which the interest accrues: the interest (being the product) which accrues from the principal (being myself) has returned to the principal (myself) for a public deduction (tax credit) for adjustment of the tax liabilities on the public/fiscal society.

XII. Acceptance: Rule 1: Do not hold the charge or you will fry on the chair. Rule 2: Pass the charge to a fiduciary entity to remove yourself from that liability by grounding the account and charging them with the charge, to discharge yourself. As the owner, you are not the holder-in-due-course for the tax adjustment; the holder-in-due-course is the holder of a business license by being registered to operate in the industrial society, which is your fiduciary like the bank or a vendor.

XIII. A request is made against you without providing a check, thus it was an order for money/money order, that is why you RETURN (tax return) the offer after acceptance to the Offeror because the Offeror is holding your check as your fiduciary and they need to Pass Thru your account to make their check good which in turn reflects itself as a deduction to the entities tax liability making the credit memo to the account for the tax adjustment good, and allowing the release of the goods to the acceptor and now there is no debt claimed on the account. The ticket, bill or presentment is the instrument they use to make the claim against you; if you give them back the original and now it is in their possession, how can they possibly make a claim against you when they are in possession of their own bill. In other words it is said, An offer is made against you to pay, which debits your value and to balance that value, you need a credit. Your acceptance of their offer returned to them satisfies the Replevin Bond by operation (under the Grace of Public Policy H.J.R.-192). That is why you accept and return (tax return) the original, yourself being the sponsor for the credit to the account through your exemption. The reason you return the original is because what the person is doing is taxing you. When you return it, it is a tax return that is eligible for adjustment with the Internal Revenue Service.

XIV. Your inter-national (inter-n’al) court orders are the Acceptances because it turns those offers into money orders to use your exemption. When you accept and return an offer and they refuse to adjust, they are the ones who are in contempt of court, not you. The scriptures talk about a door that you can walk in and out of, well that is the door to the warehouse, it is the “Receiving & Discharge” door and it is “Your House,” because you are the one that is revenuing the currency from a public jurisdiction of debt back to your private jurisdiction of credit and effectively redeeming the debt. This is why we want the order of the court released to us; it is because it is our court we are exercising. The court/bank/corporation is using your exemption to write checks to them self by bonding against you to claim you as a dependant and an infidel that has to get locked up. If you stick strictly with the “where is my check?” attitude, they have to clean their books to meet their record keeping obligations. If you want to push paper, they will push paper. Only utilizing one side of the account (the paper pushing), the steamroller will get revved up. Operating in both sides of the account we have the paper and the oral proceedings. Learn to utilize both sides as the owner of the account. You are catching the corporation (your fiduciary employee) spending against you (in your “absence”) and they are trying to make you pay for what they did, when it is against Public Policy to make you pay in the first place. And for them to make a claim against you, they have to give you a check (the one you write about having not found in their offer) to post for their Replevin bond and when they don’t do that, they have no claim in fact because they didn’t post the reserves to indemnify their actions because you would endorse it back to them paid in full. When they fail to release the order of the court during your written correspondents with them after you have accepted, they are then in dishonor and lose their exemption and can have no claim.

XV. Root Policy is the linear algebra f of x from Notice to Data to Information to Knowledge; the Linear function f of thought. Squared Policy is the planar geometry f of x=y from Audit to Assessment to Assurance to Adjustment; the Planar function f of the word, i.e. the application of algebra over a field. This is the due process of Mind Software (Mindsoft) operation.

XVI. A Policy of Adjudgment arising out of any Policy of Assurance which is raised into Question shall issue from a just and equitable court of competent jurisdiction.